AVOK LOANS

APPLY FOR A LOAN

TYPES OF LOANS AT AVOK

PAY-DAY LOANS

Borrow once. Payback once.

Sometimes you just need a quick once-off loan for an unexpected expense or a more difficult month than usual. Use our pay-date loan as your overdraft facility!

- Borrow up to R8000-00, and repay at the end of the month.

- You need to be employed to apply.

- Bring along: SA ID Book/Card, latest pay slip, 3-month bank statement, bank card (to swipe), proof of residence.

- Pensioners earning their money in a bank account welcome.

- Weekly & Fortnightly earners welcome.

TERM LOANS

Pay back your loan in smaller, affordable installments.

- Borrow up to R8000-00, repay up to 6 months.

- You need to be employed to apply.

- Bring along: SA ID Book/Card, latest pay slip, 3-month bank statement, bank card (to swipe), and proof of residence.

- Pensioners earning their money in a bank account welcome.

- Weekly & Fortnightly earners welcome

HOME IMPROVEMENT LOANS

Do you have a dream for your home, but it is difficult to realize it without money?

The Home Improvement Loan might be your answer.

- Use the money to build in phases or to do renovations to your home.

- Borrow up to R10000-00, and repay up to 12 months.

- You will need your SA ID Book/Card, latest pay slip, 3-month bank statement, bank card (to swipe), proof of residence, quotation for building materials and quotation for labour costs.

- Loadshedding? Come see us to assist with getting the funds and discounted prices on Invertors

MORE INFO

MAKING FINANCE EASY

- A personal loan is an unsecured loan that is available to individual customers. We give a maximum loan amount up to R8000 and offer a repayment period between 1 to 6 months. A personal loan is unsecured which means you don’t have to offer security in order to get your loan approved.

- Always ensure you choose a financial provider that suits your needs and are registered with the National Credit Regulator (NCR).

- Your personal loan is yours to spend on anything you like.

- Make sure you have a personal budget with your Income and Expenses to ensure you can afford the monthly repayments.

- Our fixed interest rate and contract cost means your monthly repayment will stay the same for the whole term.

- Make sure you understand the cost and conditions of a loan before you accept an offer.

- Consider a personal loan rather than a retail account, since the total repayment will be considerable less.

- A good credit record is something that every consumer need. If you consistently meet the necessary repayments you’ll build up a solid credit record and should you apply for further credit, such as other loans or accounts, you’ll be more likely to be granted the credit you need.

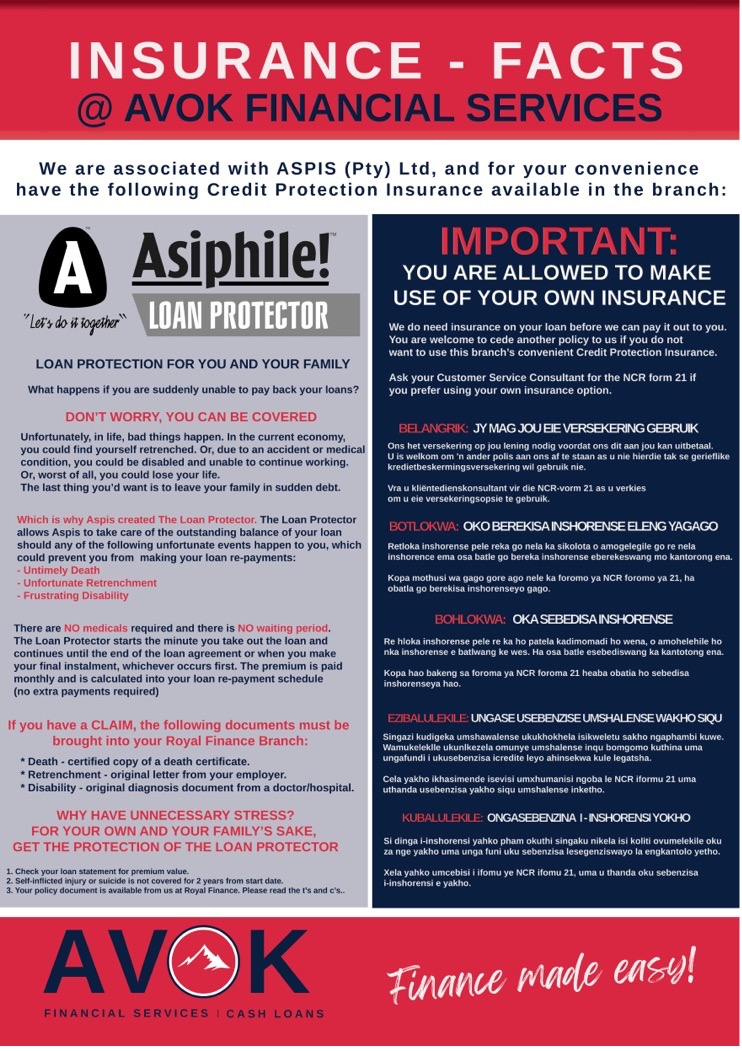

- We make use of Aspis for our Loan Protection Insurance.

- You are allowed to make use of your own credit insurance – please review the information sheet underneath.

- You can also speak to us about our Funeral Plan available to all our clients.

- We will always contact you from our office or company WhatsApp number.

- Remember who you spoke to and make sure we verify our identity.

- We will not ask you to share your bankcard pin over the phone.